The year is unfolding exactly as we had outlined it could.

With intensity, uncertainty, geopolitical noise, and a news cycle that systematically trades on fear and insecurity. Since 2025, we have consistently emphasized in our articles that markets do not move based on headlines, but on the direction of strategy and the timing of decisions.

That is precisely what we are witnessing today. While public discourse revolves around conflicts, tariffs, and statements, markets are moving preemptively, not reactively. And this preemptive behavior is not about calm, it is about structure: who has a plan, who has time, and who has the capacity to absorb pressure.

Since 2025, we have repeatedly underlined that Europe was positioned on the wrong side of decision-making. Not only in geopolitical terms, but more importantly in economic strategy, energy policy, and institutional flexibility. Europe’s choices have been driven more by ideological rigidity than by realism of power.

Despite the rhetoric surrounding Donald Trump, tariffs, trade disputes, and geopolitical tensions, markets do not appear fearful. On the contrary, they are pricing in the idea that this period of tension represents a transition phase, not a destination.

The fact that equity indices are trading at historical highs, while interest rates remain above levels Trump would consider desirable, reinforces the view that markets are positioning for the next phase:

a phase in which a resilient economy, a controlled deceleration of inflation, and, at a later stage, monetary easing, will operate in tandem.

In contrast to the European Union, where uncertainty often paralyzes decision-making, in the United States uncertainty appears to be priced in and actively utilized. And this is often why, at the end of each cycle, markets tend to reward strategy rather than rhetoric.

From 2026 onward, we believe Europe may increasingly face the cost of its own choices, as we have been highlighting for several months. Delayed adaptation, energy dependence that has merely shifted rather than been resolved, and the absence of a coherent and effective industrial policy are creating an environment of mounting economic and social pressure.

The most concerning factor is not solely the economic impact, but the growing risk of political fatigue and institutional skepticism. A phase of resistance to European integration itself cannot be ruled out among certain member states, not necessarily through immediate exits (though beyond 2027 nothing can be entirely excluded), but through indirect disengagement, national prioritization, and the strengthening of Eurosceptic forces.

Unlike the United States, where strategic confrontation often functions as a tool for power realignment, in Europe similar tensions tend to result in decision paralysis.

The slogan “DRILL BABY DRILL”, repeatedly voiced by Donald Trump, and notably the title of one of our articles back in 2025, was not merely a rallying cry for the American energy industry. It encapsulated a broader geoeconomic strategy, one that did not aim at high oil prices, but at controlling supply, and ultimately, controlling power.

Since early 2025, we have stressed that tariffs, trade disputes, and aggressive rhetoric were not isolated actions, but components of a plan with a clear sequence. Energy oversupply, pressure on trade partners, and the strengthening of domestic productive capacity function as interconnected vessels within that strategy.

Abundant oil production translates into lower energy costs, controlled inflation, and a stronger domestic economy. Within this framework, even the potential reactivation of Venezuela’s vast reserves serves as a strategic lever of pressure on markets and traditional supply regulators.

Despite the absence of the traditional Santa Rally, one that did not validate our expectations, markets are now trading at new all-time highs and continue to advance. This is not a contradiction; it is a sign of maturity. The lack of an emotional, seasonal surge created room for accumulation and selective positioning.

Particularly noteworthy is the performance of Russell 2000, which is reaching new highs for the first time since 2021. This index reflects the real, internal U.S. economy, small and mid-sized businesses, domestic consumption, and productive activity. It is precisely here that the resilience of an economic cycle is built.

At the same time, interest rates remain higher than Trump would prefer. And here the critical question emerges: could this, too, be part of the strategy? Could sustained pressure be functioning as a filter, allowing the next phase of easing to find both the economy and markets on a healthier footing?

Without grand statements but with a clear direction, markets appear to be favoring:

- the domestic economy over narrative, the real economy over excessive leverage, strategic positioning over short-term speculation.

Not because “everything is fine,” but because some dynamics are priced in long before they become visible.

Markets do not wait for confirmation. They position themselves before it becomes obvious.

Two recent developments add new layers of tension and warrant close monitoring. First, Donald Trump’s public attack on Jerome Powell, triggered by the high cost of the Federal Reserve’s building projects, shifts the confrontation from monetary policy to institutional function and central bank independence. This criticism reopens the debate on transparency, accountability, and the role of the central bank at a time when the cost of money remains elevated, and on whether a central bank that demands discipline from the economy applies that discipline first to itself.

Second, the proposal to impose a 10% cap on credit card interest rates in the United States introduces a new axis of intervention in consumer financing costs. Regardless of whether or how it will be implemented, the message is clear: pressure is now being transferred directly to consumption and bank margins. As usual, markets will attempt to price in whether this represents an isolated move or a precursor to broader intervention.

Through the fear and insecurity amplified by the news cycle, capital continues to move preemptively, searching for strategy, consistency, and timing. And when strategy follows a clear timetable, noise is not an obstacle, it is simply part of the journey.

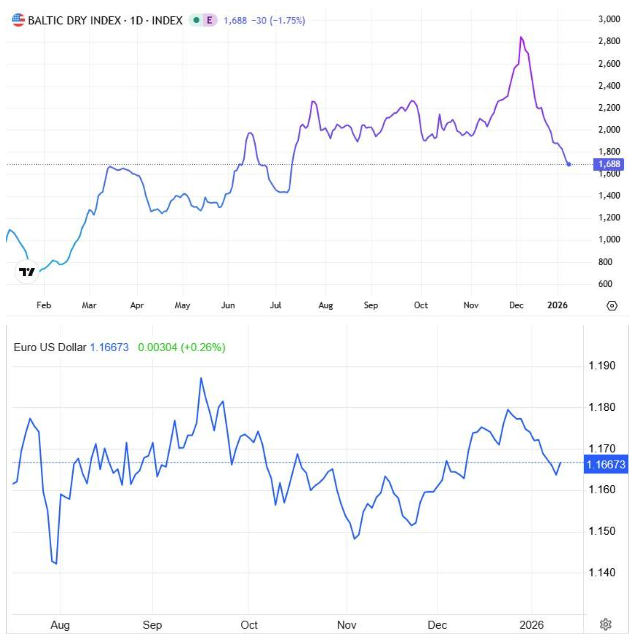

In our next article, we will move from strategy and macroeconomics to the technical and chart-based reading of markets and key sectors, presenting the forecasts and levels that, in our assessment, are likely to shape 2026. Special emphasis will be placed on shipping, which, within the new macroeconomic and geopolitical environment, appears to be preparing for significant upside, based on our models.

by Kotsiakis George