Amid global order decline, domestic firms target high-value LNG vessels as rivals restructure

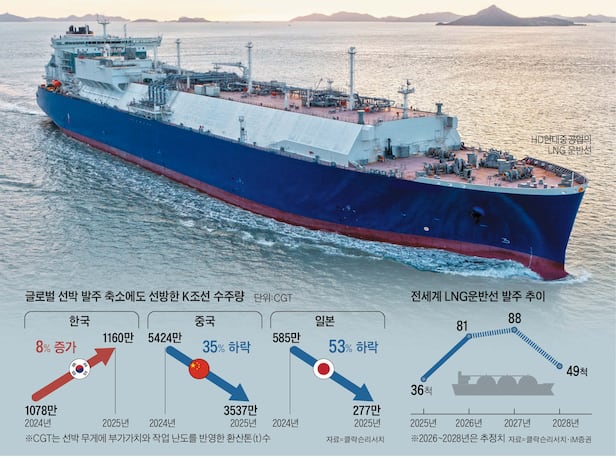

Last year, South Korea’s shipbuilding industry was stirred by the favorable news of the “MASGA (Make American Shipbuilding Great Again)” project. However, concerns grew on another front. Global ship orders plummeted 27% to 5,643,000 CGT (compensated gross tons) compared to 2024. Many questioned whether the so-called “supercycle” (boom) that began in 2021 was already ending.

Amid this, the three major domestic shipbuilders—HD Korea Shipbuilding & Offshore Engineering, Hanwha Ocean, and Samsung Heavy Industries—secured orders worth US$35.93 billion (approximately 51.97 trillion Korean won) in the global market last year. Despite the sharp decline in global ship orders, they managed to reduce their order intake by only about 1% compared to 2024. This was the result of a strategy focused on selective orders for high-profit eco-friendly vessels. They also benefited from a rebound effect as Chinese shipbuilders shrank due to the aftermath of U.S.-China tensions.

This year, South Korean shipbuilders face an unavoidable showdown. Expectations are rising that orders for high-value LNG (liquefied natural gas) carriers, which shrank last year, will resume in large numbers. South Korea holds a dominant first-place position in LNG carriers. These ships, which transport natural gas in a supercooled liquid state at minus 162 degrees Celsius, require advanced technology and are expensive, making them highly profitable. As of the end of the third quarter last year, the three companies’ order backlogs stood at 135 trillion Korean won, with work secured until 2028. However, given the ongoing decline in new ship orders, they must widen the gap in LNG carriers this year to maintain profitability over the next 3–4 years.

◇2025: South Korea’s Shipbuilding Industry Holds Its Ground

The sharp decline in global ship orders last year was due to reduced demand for new ships as vessels ordered in large quantities from 2021 to 2023 began entering service. Additionally, the trade war triggered by U.S.-China tensions contributed to the contraction. Geopolitical uncertainties led to a general shrinkage in trade. Amid this, South Korean shipbuilders managed to perform well by actively entering the container ship market.

Container ships were originally the domain of China, which leveraged low-cost labor. However, recent strengthened environmental regulations have increased container ship prices. As expensive eco-friendly equipment, such as dual-fuel systems capable of using LNG and ammonia, began to be installed in container ships, profitability improved. South Korean shipbuilders aggressively pursued orders. Last year, the three domestic shipbuilders secured LNG carrier orders worth US$8.63 billion, but their container ship orders reached US$15.71 billion—nearly double that amount.

◇This Year’s Battlefield: LNG Carriers

This year, LNG carriers are the key battleground. There are expectations that large-scale LNG power generation projects will begin, particularly in the United States. LNG is seen as a bridge in the transition from fossil fuels like coal and oil to renewable energy, and demand has been growing rapidly. Within the shipbuilding industry, there are forecasts that global LNG carrier orders could reach around 80–100 vessels this year. Already, on the 6th, HD Korea Shipbuilding & Offshore Engineering secured its first order of the year by winning a contract to build four LNG carriers worth 1.5 trillion Korean won, ordered by a U.S. shipping company.

However, competing countries are also restructuring their shipbuilding industries to rebound. In Japan, the original shipbuilding powerhouse, the largest shipbuilder, Imabari Shipbuilding, announced on the 5th that it had completed the process of making the second-largest shipbuilder, Japan Marine United (JMU), a wholly owned subsidiary. This marks the emergence of a global top-four shipbuilder. The company’s president, Yukito Higaki, stated, “We will further strengthen our competitiveness and accelerate LNG carrier construction.” Earlier, in September last year, CSSC (China State Shipbuilding Corporation) and CSIC (China Shipbuilding Industry Corporation), China’s top two shipbuilders, also completed their merger. Chinese shipbuilders, who account for 60–70% of the global shipbuilding market, could intensify their price and volume offensives.

Source: The Chosen Daily